Trend Following Strategy: Bullish Trend Reversal in Place

In the overall Bull Market, which should last through 2025, we get bullish and bearish trends that last 9 - 26 days on average. Today, we confirmed a new Bullish Trend.

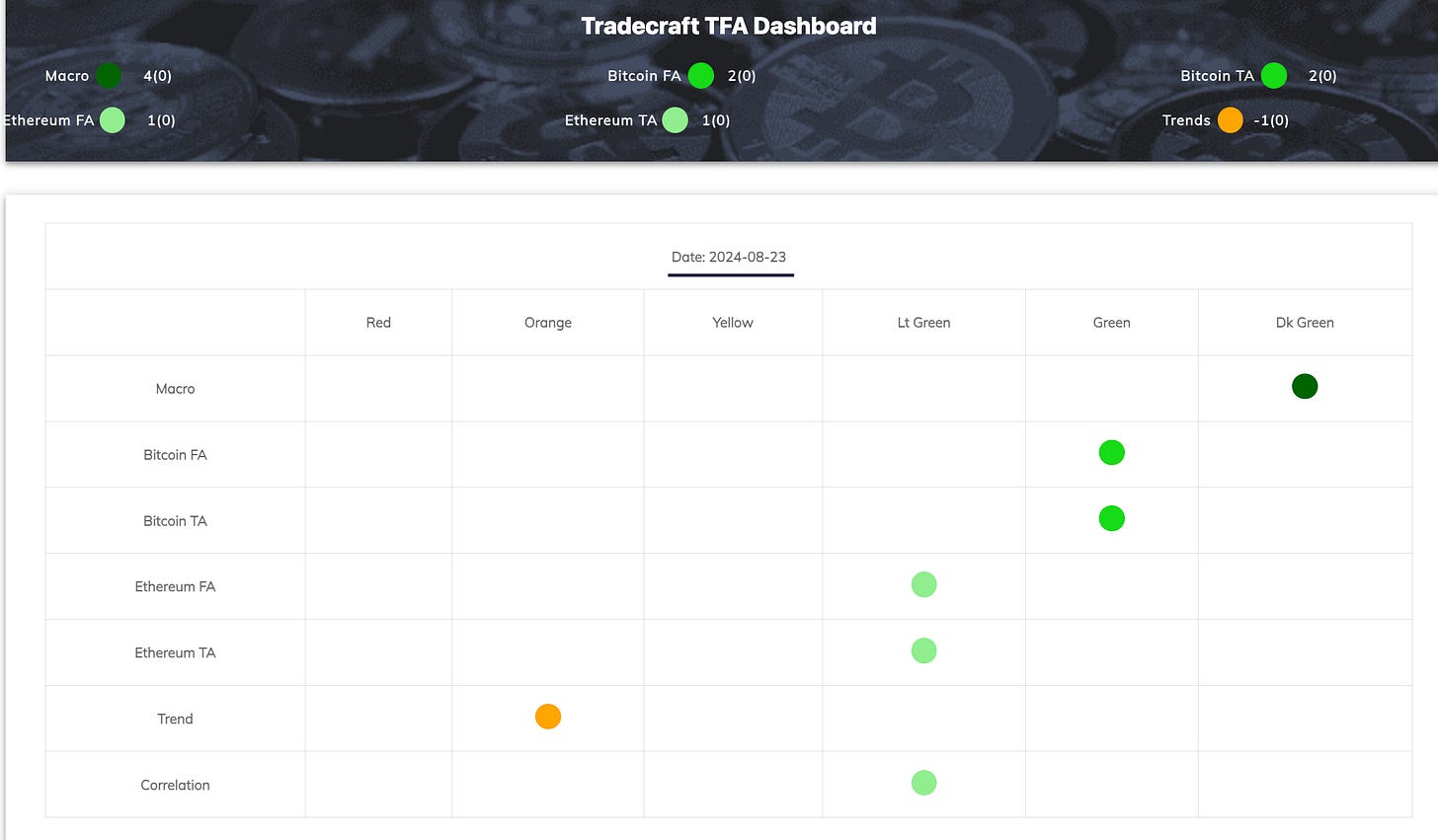

Today mark’s Confirmation of a new Bullish Trend. Below, you can see from our TFA Model, we marked Early Indication of a Bullish Trend Reversal on Wednesday, August 21st. Then today, we marked Confirmation of that Bullish Trend Reversal.

As you can see in the TFA Model, Bitcoin Fundamentals and Technicals are Green and Ethereum Fundamentals and Technicals are Light Green. That means Bitcoin is leading the charge relative to the two.

Solana is also one of the strongest growing L1s, which leads us to believe that Bitcoin and Solana will outperform Ethereum in the back half of 2024. We would need to see a change to the data and the charts to switch our position, but it seems to be the case that Ethereum is not growing as well as the other two. This could be partially due to the fact that the L2s working on top of Ethereum are garnishing their growth, cannibalizing Ethereum - at least until the L2s collectively can add to Ethereum’s overall growth story. We see below, the Ethereum blockchain has continued growth. The question is - Where does the value create from and where does the value accrue?

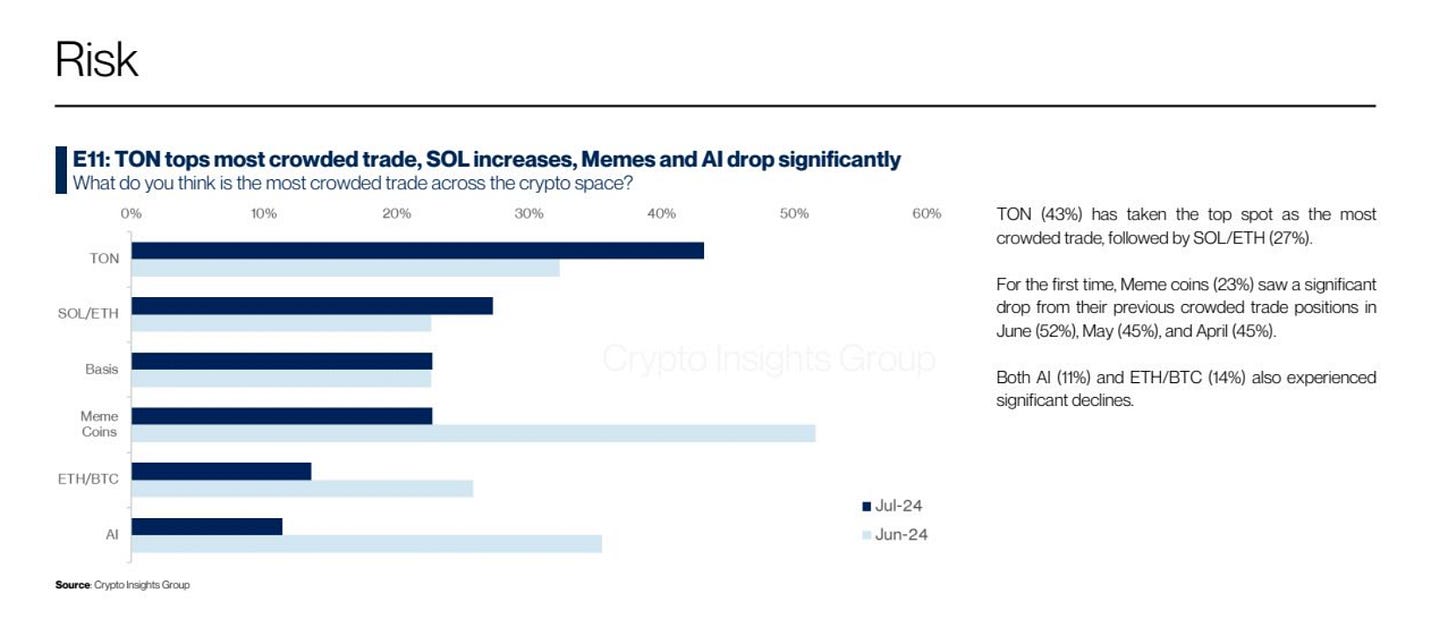

There other L1 that’s gained a ton of attention in 2024 is TON, Telegram’s Open Network. However, in a survey by Crypto Insights Group of 44 crypto portfolio managers, it appears TON is the most crowded trade.

The Charts

Bitcoin’s Chart

As you can see here, Bitcoin just today traded above its 200-day moving average. Moreover, the price has been putting in higher highs and higher lows. This is what we’ve been waiting for. As I’ve written about in previous writings, we expect this bull cycle to last longer than past cycles. The reason is that in the past cycles of 2012, 2016 and 2020, the Bitcoin Halving Event occurred at roughly the same time as the Fed’s expansion of its balance sheet and the expansion of the M2 Money Supply. This time around, the easing/expansion is happening roughly 6-9 months after the Halving event. We believe its the expansion of the balance sheet and the money supply that drives crypto, more than the Halving event. So, this party is just getting started with the Fed’s announcement today that they’ll begin cutting rates in September.

We need to trade above the previous high of $68k and then the previous high of $72.3k to confirm the next leg of this bull run. If we do not break $68k, that could indicate we continue rangebound between $68k and $54k.

Ethereum’s Chart

As you can see in the chart below, Ethereum is not quite on the same page as Bitcoin. While it’s now trading above its 20-day moving average, price needs to rise substantially to get back above its 200-day moving average. This is important to crypto’s overall story, so we’ll be watching Ethereum to see how it trades. For now, we have a bigger position in Bitcoin and Solana in the L1s.

As you can see in the above chart, the blue line, which is the 20-day moving average (short-term trend) is finally reversing and trending up. The important price to watch is $3,250 where ether will finally trade above its 200-day moving average, solidifying its long-term bullish trend.

Solana’s Chart

Checking the chart below, you can see the price in Solana traded back above its 200-day moving average. This chart also shows higher highs and higher lows, which is exactly what we want to see for a bullish trend reversal. We want to see SOL trade above $163, a previous high, and then above $185 to confirm we’re no longer rangebound.

Conclusion

The charts and the data are showing we’ve entered a bullish trend reversal. Bitcoin and Solana are trading above their 200-day moving averages for the first time since early August. The Fed’s announcement regarding rate cuts are driving crypto prices higher. Remember, crypto is the antidote to monetary inflation. When the Fed cuts rates, more loans are generated and in turn the money supply increases. When the money supply increases, crypto prices rise. As stated, crypto is the antidote to monetary inflation.

This bullish trend reversal could be on the longer, in terms of its duration. We’ll need to wait and see whether or not we can break the previous all-time highs. I think we have a chance that the upside we all expected from Q4 has come early. Regardless, this new bullish trend is here and it’s time to take advantage of it.

Happy Hunting,

Jake Ryan

CIO, Tradecraft Capital

Author, Crypto Investing in the Age of Autonomy & Crypto Decrypted