The 3 DeFi Crypto Assets to Outperform in 2025

In this article, we outline the 3 DeFi crypto assets we believe will outperform in 2025.

Opening Statement & Table Setting

So, where are we in this bull cycle? A lot of this has to do with the maturity/duration of outstanding USTs (US Treasuries), and the refinancing cycle that continues. The median duration of outstanding debt is 59 months, while the target median duration is 80 months (they state 65-months in the FT graphic below). This is what’s helped support the 4-year cycle that’s continued over the last decade or more in crypto (and possibly more impactful than Bitcoin’s 4-year Halving Event.)

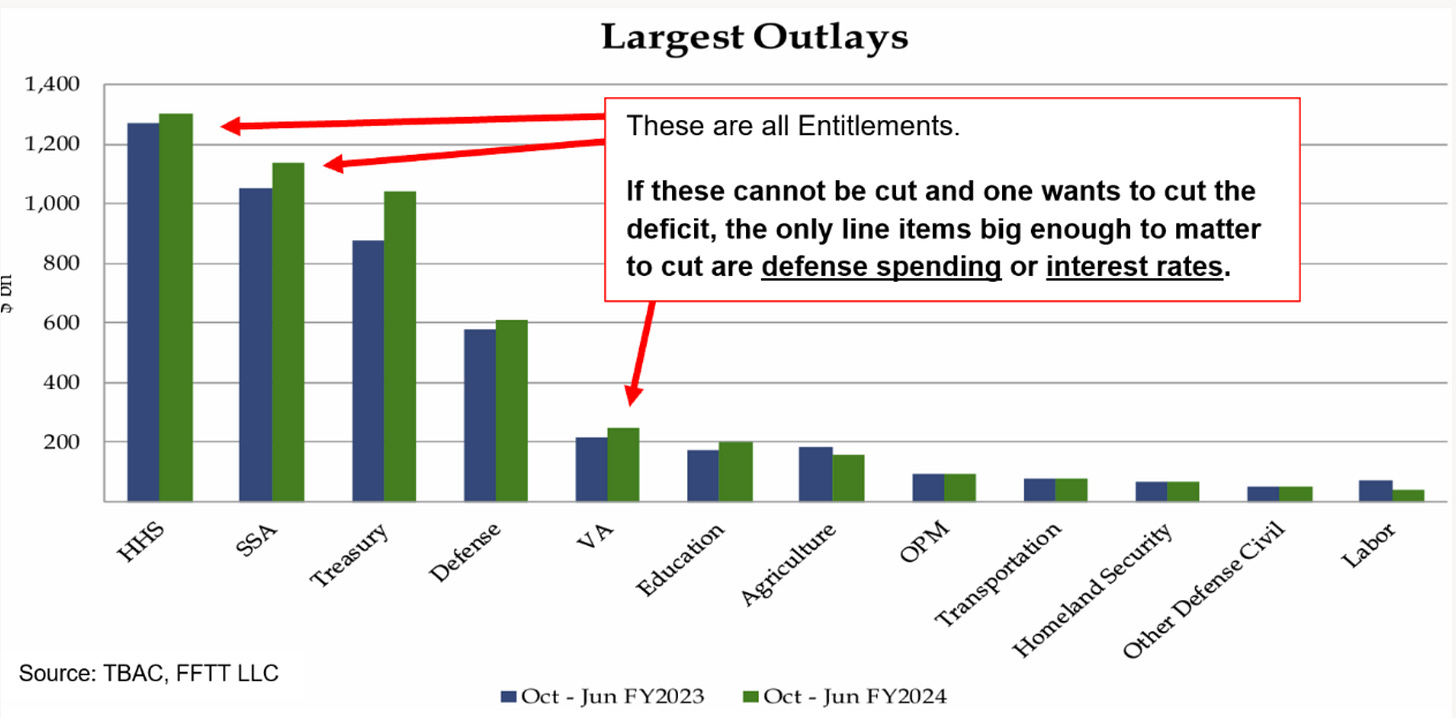

As of September 18, we started Phase II of this bull cycle. It begins with cutting interest rates here in the US. One of the primary drivers of this rating cutting cycle, we believe, is the fact that US entitlements and defense cannot (easily) be cut and the 3rd biggest expense is debt service (see below) at roughly $1.2T. Since it doesn’t look like we’re going to have a balanced budget anytime soon, the only way to reduce Uncle Sam’s debt service payments is to refinance the rolling USTs at a lower rate. In past cycles over the past 25 years, they’ve cut rates to 0%, twice and down to 1.25% once.

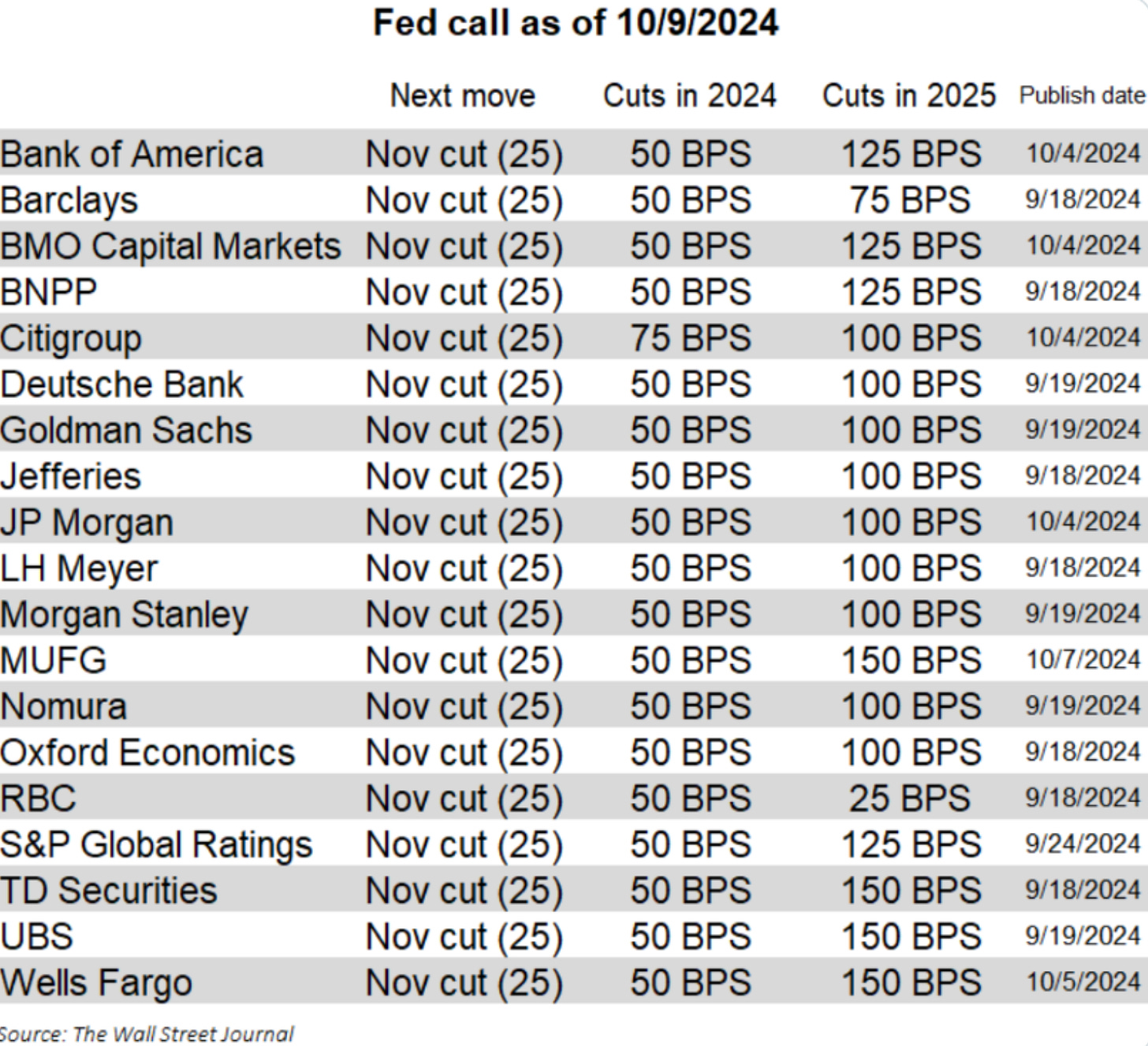

All rate-cutting cycles have cut the Fed Funds rate lower than 2%. And, we don’t think this time will be any different. Checking with big institutional players out there, we do not hold the consensus view. Most think rates may drop to roughly 3% but not lower (see below). We believe the Fed needs to refinance the current $500b/wk USTs, locking in the lowest rate for the longest duration.

(H/T Both IGs from Luke Gromen, FFTT-Inc.com)

We expect either a real problem to come down the pike in 2025, like the $500b+ commercial real estate loans that many may default. Or, a manufactured problem like illiquidity in the bond market to force the Fed to act and drop rates lower than most people believe sometime by Q1 of 2026.

It’s rate cutting and some form of QE, quantitative easing, or more broadly some form of Fed balance sheet expansion that’s required in 2025 to keep the financial markets in harmony. Famed macro investor Raoul Pal believes the Fed needs to expand the balance sheet from $7T to $12T to keep the markets functionality based on current fiscal policy. It’s this part of the liquidity cycle where more infinite dollars chase finite assets like stocks, gold and crypto.

Keep reading with a 7-day free trial

Subscribe to The Age of Autonomy Update to keep reading this post and get 7 days of free access to the full post archives.