After the Age of Information, We're Now in the Age of Autonomy

Still think we're in the Information Age? Technological revolutions drive the long-wave economic cycle.

Technological Revolutions

One of my favorite books is Technological Revolutions and Financial Capital by Carlota Perez. In this book, she identifies how new clusters of innovation come together in a cyclical nature to drive the long-wave economic cycle.

🔁 Her Core Thesis:

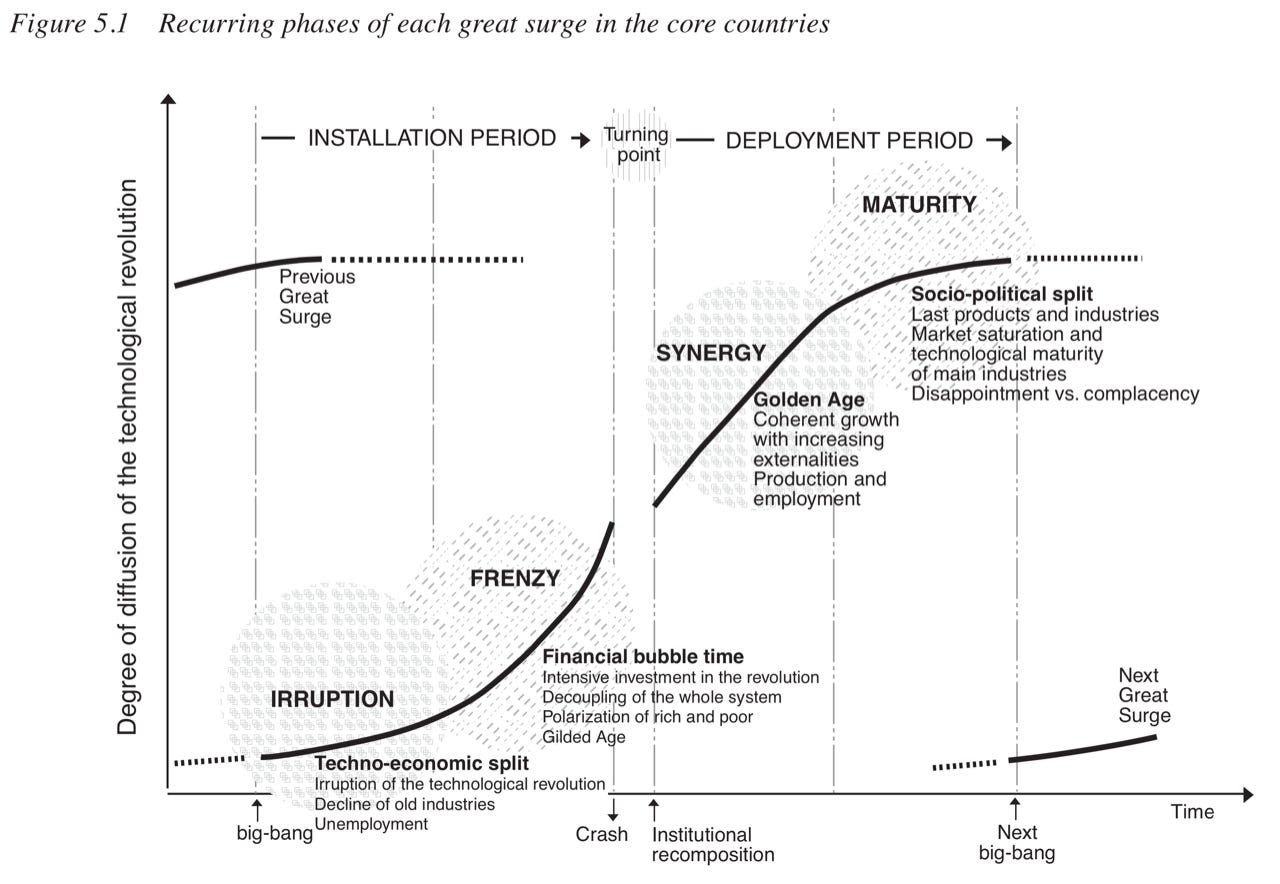

Perez argues that technological revolutions occur in recurring cycles, and each one follows a common pattern. These cycles are deeply intertwined with financial capital, which both enables and distorts the diffusion of new technologies.

🌀 The Five Technological Revolutions (so far):

Industrial Revolution (1771)

Age of Steam and Railways (1829)

Age of Steel, Electricity, and Heavy Engineering (1875)

Age of Oil, Automobiles, and Mass Production (1908)

Age of Information and Telecommunications (1971–present, though I argue 2020)

📈 Each Revolution Follows a 4-Phase Pattern:

Irruption – A breakthrough technology emerges, disrupting the status quo.

Examples: Steam engine, microprocessor.

Entrepreneurial activity begins, but adoption is uneven.

Frenzy – Financial capital floods in, often fueling speculative bubbles.

The economy experiences increasing inequality and creative destruction.

Old institutions struggle to adapt.

Turning Point – The bubble bursts or there's a crisis.

Society is forced to restructure and regulate.

Institutions and policy realign with the new technological paradigm.

Synergy – Productive deployment of the technology.

"Golden Age" of growth, equality, and stable returns.

Examples: Post-WWII boom (Fordist mass production), or potentially the current digital phase post-2020.

💰 Financial vs. Production Capital:

Perez makes a key distinction:

Financial capital seeks fast returns and can create bubbles.

Production capital builds long-term value by investing in the real economy.

During the frenzy, finance dominates, but in synergy, production takes over.

📌 Want token selections, valuable metrics and trade triggers? Only available for paid subscribers.

🌍 Implications:

Understanding these cycles helps policymakers and investors make better decisions.

Misalignment between financial capital and production can lead to social unrest and crises.

Golden Ages are not automatic—they require intentional policy and institutional reform.

📌 Key Takeaways:

Technological change is not linear—it’s cyclical and systemic.

Finance plays a dual role: accelerator and destabilizer.

Long-term prosperity depends on navigating the turning point wisely.

We're likely in or nearing the turning point of the current ICT (Information & Communication Technology) revolution—possibly heading into its synergy phase.

What’s After the Age of Information?

In my first book, Crypto Investing in the Age of Autonomy, I outline a thesis that we’ve entered a 6th technological revolution - the one after the Information Age.

It came together by way of a new cluster of innovation that built on top of technology from from the Information Age. The 4 noble technologies are: IoT, AI, Robotics and Blockchain. Simply put:

IoT (Internet of Things) produce a massive amount of Data

AI (Artificial Intelligence) turns Data into Knowledge

Robotics uses Knowledge to generate economic activity in the physical realm

Blockchain uses Knowledge to generate economic activity in the digital realm, without human intervention

Just like specialized knowledge generated an economic edge in the Age of Information, it’s autonomous operations that will generate an edge in the Age of Autonomy.

🔁 Perez’s Framework + The Age of Autonomy

Using Perez’s model, here’s how crypto, AI, and decentralization fit into her historical lens:

1. Irruption Phase (2008–2016)

Key Breakthroughs: Bitcoin (2008), Ethereum (2015), machine learning breakthroughs, cloud infrastructure.

Early adopters began exploring the decentralized web, tokenization, and autonomous systems.

The general public and legacy systems remained skeptical or unaware.

2. Frenzy Phase (2017–2024)

Speculative excess: ICO boom (2017), DeFi Summer (2020), NFT mania (2021), memecoins, AI hype.

Financial capital floods in, often disconnected from productive outcomes.

VC behavior shifts: focus on token launches, fast exits, and hype-driven valuations.

Misalignment between financial speculation and real infrastructure building.

Regulatory pushback begins (SEC, global scrutiny).

3. Turning Point (2025–2029?)

Likely happening now.

Speculative bubbles deflate or rotate into more sustainable models (e.g., ETH moving toward real-world use cases, AI shifting toward agents and autonomy).

Society wrestles with impacts: AI replacing jobs, centralization threats (OpenAI, Meta), surveillance capitalism vs. autonomy.

Crypto faces legitimacy battles: institutional adoption through ETFs on one side; decentralized infrastructure (DePIN, DAOs) growing on the other.

This is a critical period for institutional and policy alignment.

We’ll get through the Turning Point when new legislation allows for new token structures and tokenomics more conducive for value accrual.

This will drive the next wave of financial investment which will create the production capital needed to support true economic transformation - autonomous transactions in the Autonomous Economy driven on decentralized financial public infrastructure run on blockchain technology.

4. Synergy Phase (2029–2039?)

Real economic integration: AI agents, crypto rails, and DePIN create autonomous economic actors and machine-to-machine commerce.

The Autonomous Economy as outlined in CRYPTO DECRYPTED.

Institutional support follows new alignment (e.g., AI-native regulation, decentralized identity standards).

Crypto becomes infrastructure, not speculation.

Age of Autonomy matures: systems make decisions, move capital, and execute without central human intermediaries.

Conclusion

We’re in a new technological revolution. Crypto & AI are the “Techno-Economic Paradigm” of the Age of Autonomy. Just as railroads reorganized the economy in the 1800s, blockchains and AI agents are rearchitecting trust, value exchange, and cognition. These technologies are akin to the search button/search engines of the Information Age. The synergy phase requires production capital and policy support to scale these systems safely and inclusively.

Remember, investing in the technologies of the current long-wave cycle is how generational wealth is created. Stay tuned for more articles on exactly what investors should be looking for in these early days of the next technological revolution.

Happy Hunting,

Jake Ryan

CIO Tradecraft Capital &

Author, Crypto Investing in the Age of Autonomy

Author, Crypto Decrypted

PS I would love to hear some questions posted, so please… don’t be shy!